Social security wep calculator

Penetration Testing Training Boot Camp. Theres an estimated monthly retirement benefit for example which will vary depending on the age you start collecting.

1

Estimate of spouse benefits for yourself if you receive a pension from a government job in which you did not pay Social Security taxes.

. You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. Social Securitys online services are here to put control at your fingertips. Wizmo is a lightweight Windows Gizmo offering a wide array of handy Windows commands.

See what else you can do online at SocialSecuritygov. Estimate if you are eligible for a pension based on work that was not covered by Social Security. The default settings cannot be modified.

The Social Security WEP Calculator. Choose two WEP uses the same encryption features as Bluetooth. Ultimately the security of your personal data is your responsibility.

If in the course of your career you worked for both 1 at least one employer that did withhold Social Security taxes and 2 at least one employer that didnt withhold Social Security taxes and that offers a pension the windfall elimination provision WEP may come into play. This free utility can help. A non-covered pension earned by your spouse has no bearing.

Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected. A Social Security break even calculator can help with the decision but it can never be the sole factor used if you are serious about making a well-rounded decision. The key is static and repeats on a congested network.

The WEP calculator and GPO calculator at Social Securitys website can help you estimate how much these rules will cut into your benefit. If you work or have worked for a company that gives you a pension based on work not covered by Social Security the basic calculators above arent an accurate representation. The WEP and GPO can be awful surprises so Im glad youve taken.

The WEP may apply if you receive both a pension and Social Security benefits. Handles all Social Security benefits for ALL households. If you had between 20-30 years of substantial earnings covered by Social Security the WEP may still apply but at a reduced level.

The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. On paper your Social Security statement seems straightforward enough. These rules apply only if you are collecting a non-covered pension based on your own work and some kind of Social Security benefit.

The WEP is simply an alternate formula for calculating Social Security benefits for those who have a pension from a job where no Social Security taxes were paid. Since not all Internet servers are equally secure knowing which server software a web site is using can be important to your security. Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement benefits for workers who also collect a non-covered pension from a job in which they didnt pay Social Security taxesThe provision affects about 19 million Social Security beneficiaries.

Which two reasons describe why WEP is a weak protocol. Your benefit may be offset by the Government. It includes a link to an online WEP calculator that can tell you how your Social Security benefits may be affected by your non-covered government pension.

This calculator will tell you. Full retirement age. If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount.

You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement. The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. For more information about how WEP works and a list of exceptions review the Windfall Elimination Provision PDF and use the WEP Calculator to see how your Social Security benefit may be affected.

Easy-to-Use Social Security Calculator. Skip advert There are ways you can lower. The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP.

You will need a. The key is transmitted in clear text. Infosecs 10-day Penetration Testing Boot Camp is the industrys most comprehensive ethical hacking training available.

Windfall Elimination Provision WEP Government Pension Offset GPO. Windfall Elimination Provision WEP Calculator. We hope this explanation.

Everyone on the network uses a different key.

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

Jl Ethr Qxmknm

Social Security Windfall Elimination Wep Gpo Youtube

A Comprehensive Guide To Social Security After Divorce

The Social Security Windfall Elimination Provision Issues And Replacement Alternatives

3

Ask Larry Will Social Security Fix The Problem In Calculating Benefit Rates For Those Born In 1960

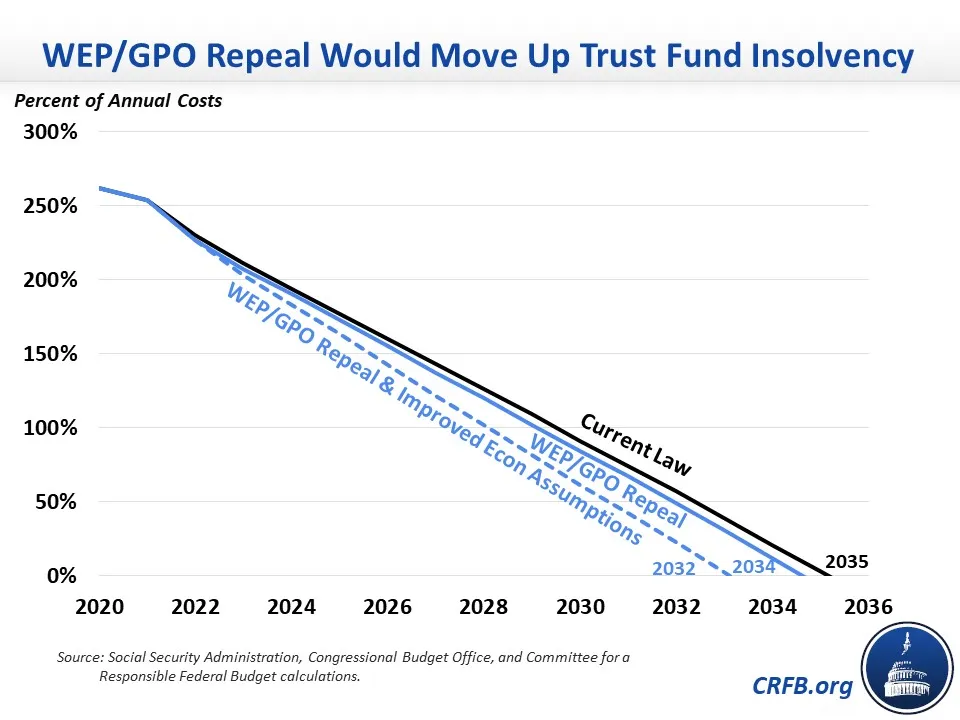

Wep Gpo Repeal Would Mean Earlier Insolvency For Social Security Committee For A Responsible Federal Budget

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

The Windfall Elimination Provision Plus The Two Most Common Ways To Sidestep Youtube

Program Explainer Government Pension Offset

Social Security

Social Security Totalization Agreements

Will Your Social Security Benefit Be Recalculated Youtube

1

Will I Avoid The Social Security Windfall Elimination Provision Isc Financial Advisors

The Wep Is Unfair And Here S Why Ways And Means Republicans